nebraska vehicle tax calculator

Nebraska vehicle tax calculator. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680.

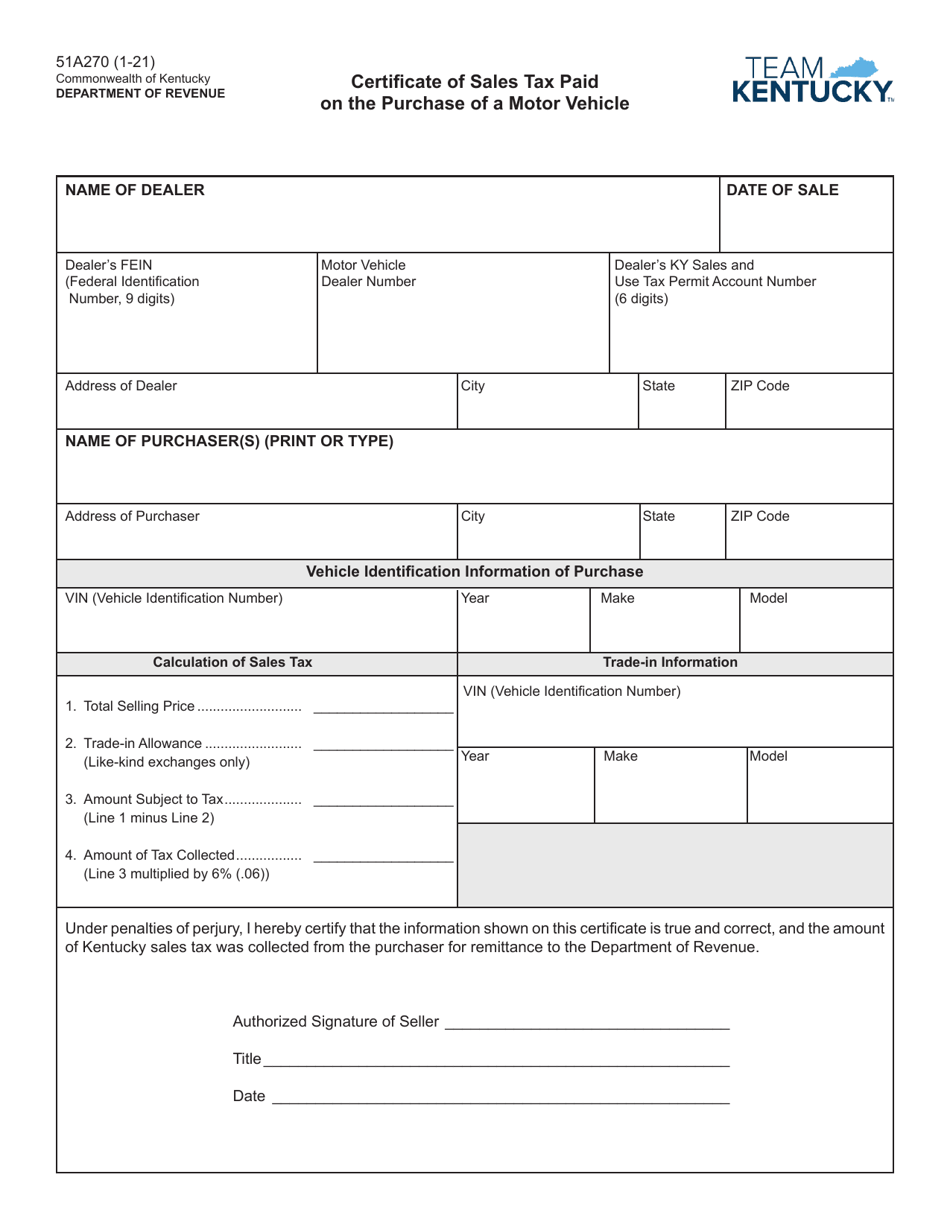

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraskas motor vehicle tax and fee system was implemented in 1998.

. You can obtain an online vehicle quote using the Nebraska DMV website. The ne tax calculator calculates federal taxes where applicable medicare pensions plans fica etc allow for single joint and head of household filing in nes. How to Calculate Nebraska Sales Tax on a Car.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. There are four tax brackets in Nevada and they vary based on income level and filing status. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918.

You must have the vehicles VIN vehicle identification number in order to get an estimate. Maximum Local Sales Tax. Subsequent brackets increase the tax 10 to 40 for each 2000 of value when new or two percent.

The tradein vehicle value is 2200 and after a tradein loan payoff of 1700 the balance of. NEW - Appointments are now available for ALL driver licensing services permits licenses and State ID Cards at the 17007 Burt Street Service Center in Omaha. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions.

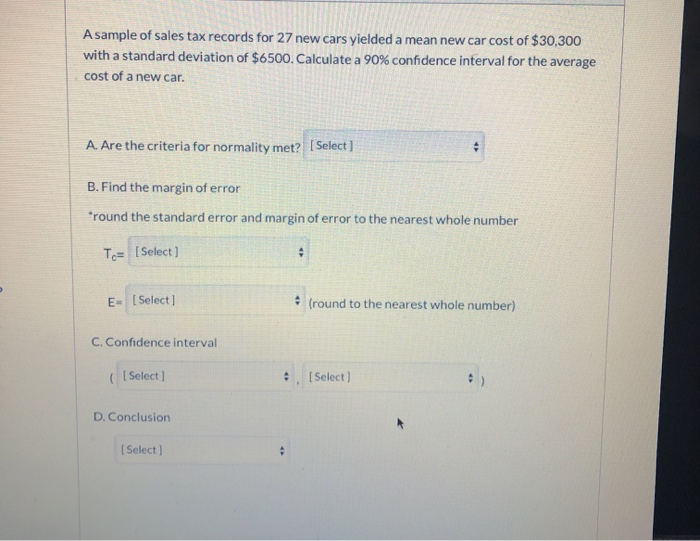

This calculator can help you estimate the taxes required when purchasing a new or used vehicle. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. 2022 June 2022 and June 2021 09022022 PDF Excel May 2022 and May 2021 08022022 PDF Excel April 2022 and April 2021 07052022 PDF Excel March 2022 and March 2021 06022022 PDF Excel February 2022 and.

You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. The higher the value of the passenger vehicle the smaller the share of the vehicle that is. The statistics are grouped by county.

If you are not a Nebraskagov subscriber sign up. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. For example lets say that you want to purchase a new car for 60000 you would use the following formula to calculate the sales tax.

All data based on your calculation. This example vehicle is a passenger truck registered in Omaha purchased for 33585. The tax commissioner assigned a value.

Motor vehicle sales tax collection information is compiled from monthly county treasurers reports. 1st street papillion ne 68046. These fees are separate from.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Before that citizens paid a state property tax levied annually at registration time. Ad We set up an accounting system audit your books foster growth for your business.

Your average tax rate is 1198 and your marginal tax rate is 22. Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item. The estimated tax and registration combined is 3624 but this may vary based on your location.

The lowest tax rate is 246 and the highest is 684. Nebraska Income Tax Calculator 2021. In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

Nebraska Documentation Fees. If you live in the city limits of Bellevue Papillion La Vista Gretna or Springfield you need to select your city to get the correct sales tax computation. Nebraskas state income tax system is similar to the federal system.

Omaha Ne Sales Tax Calculator. Money from this sales tax goes towards a whole host of state-funded projects and programs. The net price of 38250 equals the sale price of 39750 minus the rebate of 1500.

USA Tax Calculator 2021. Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above. There are no local income taxes in.

We prepare returns quickly accurately. 60000 x055 3300. A 100 fee is charged for each successful Nebraska Title Lien and Registration Record Search.

Maximum Possible Sales Tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. If you are registering a motorboat contact the Nebraska Game and Parks Commission.

Get every tax deduction youre entitled to. Note that transfer tax rates are often described in terms of the amount of tax charged per 500. Today Nebraskas income tax rates range from 246 to 684 with a number of deductions and credits that lower the overall tax burden for many taxpayers.

You can find these fees further down on the page. Nebraska vehicle tax calculator. This is less than 1 of the value of the motor vehicle.

In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car. View the Nebraska state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator. Nebraska State Sales Tax.

Average Local State Sales Tax. Its a progressive system which means that taxpayers who earn more pay higher taxes. This service is intended for qualified business professional use only to view vehicle title lien and registration information.

Your purchase will be charged to your Nebraskagov subscriber account.

Car Tax By State Usa Manual Car Sales Tax Calculator

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Calculate Sales Tax On Car Shop 52 Off Www Ingeniovirtual Com

Car Payments Calculator Car Affordability Calculator Nadaguides

Car Loan Calculator Louisiana Dealer Consumer Calculator

14 Self Storage Marketing Ideas Marketing Ideas Storage And Cube Storage

Calculate Sales Tax On Car Shop 52 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Shop 52 Off Www Ingeniovirtual Com

Using Guard And Reserve Retirement Calculators To Estimate A Reserve Pension Retirement Calculator Retirement Guard

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Sales Tax On Car Shop 52 Off Www Ingeniovirtual Com

York Maine States Preparedness

Vehicle And Boat Registration Renewal Nebraska Dmv

14 Self Storage Marketing Ideas Marketing Ideas Storage And Cube Storage

Calculate Sales Tax On Car Shop 52 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Shop 52 Off Www Ingeniovirtual Com